- South Texas Students Meet Accordion Music Icons Los Tigres Del Norte In Edinburg Thanks To Khs America/Hohner Alianza Académica Initiative

- Fragile Planet Offers a Nighttime Wildlife Experience

- Falcons Soccer Off & Running

- Cameron County Receives Funds to Improve Two Parks

- Falcons Complete First Half of 32-6A

- School District to Help out Victims of California Wildfires

- Sand Castle Days Continued Despite Unexpected Weather

- Ready for District

- Discussion of Garbage Dumpster Rates, Agreements Between State & City on Highway Regulations, and More

- 31st Annual Shrimp Cook-Off is Right Around the Corner

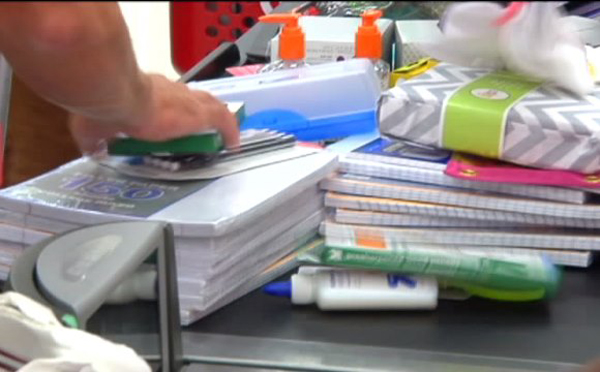

Annual State Sales Tax Holiday August 7th through 9th

- Updated: August 7, 2015

The Texas annual sales tax holiday has been set for Aug. 7-9 as families prepare for the return of their children to school, State Rep. Rene Oliveira announced Thursday.

As in previous years, the three-day tax holiday exempts most clothing, shoes, school supplies, book bags and backpacks marked under $100 from sales and use taxes. That can save Texas shoppers about $8 on every $100 spent during the tax-exempt weekend, said Oliveira, the House sponsor of the bill that created the sales tax holiday in 1999.

Sales tax must still be paid on some certain items, such as luggage, purses, wallets and watches.

“Sales tax holidays are proven winners for consumers and states alike. When people increase their purchases, they also buy taxable goods that can offset the revenue losses from increased exemptions,” said Oliveira. “Exempting basic items required in the classroom to list of exempted items is fair tax policy for everyone.”

The Texas tax break weekend has been an annual event since 1999. It’s open to anyone buying qualifying products at a store in the state or from an Internet or catalog seller engaged in business in Texas.

The school supplies exempted under the bill are those that have been agreed to by multiple states in the Streamlined Sales and Use Tax Agreement. The list was formulated by input from national tax authorities and educators. By keeping the list of exempted items consistent with SSUTA agreement, potential revenue losses to the state are kept to a minimum, Oliveira said.

The list of exempted supplies includes: binders; book bags; calculators; cellophane tape; blackboard chalk; compasses; composition books; crayons; erasers; folders, including expandable, pocket, plastic, and manila folders; glue, past, and paste stickers; highlighters; index cards and boxes; legal pads; lunch boxes; markers; notebooks; paper, including: loose leaf ruled notebook paper, copy paper, graph paper, tracing paper, manila paper, colored paper, poster board, and construction paper; pencil boxes and other School supply boxes; pencil sharpeners, pencils, pens, protractors; rulers; scissors; and writing tablets.